Income Tax Rates and Thresholds Annual Tax Rate. Find Out Which Taxable Income Band You Are In.

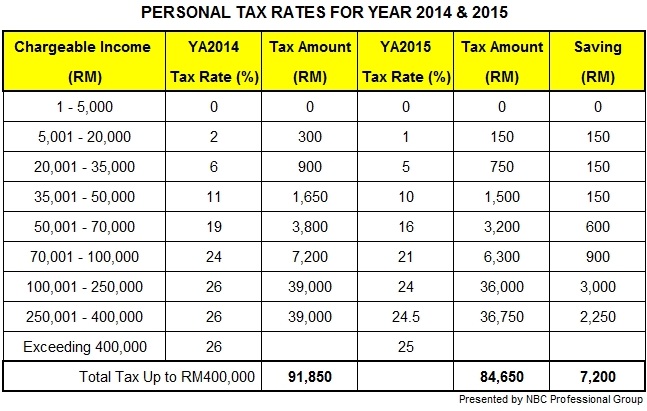

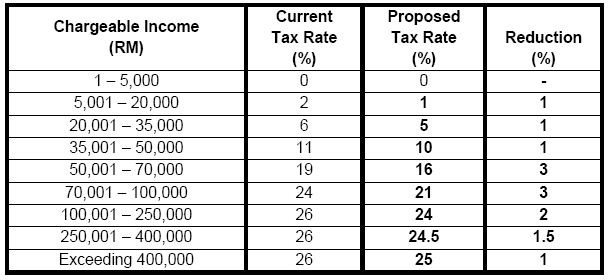

Budget 2015 New Personal Tax Rates For Individuals Ya2015 Tax Updates Budget Business News

A non-resident individual is taxed at a flat rate of 30 on total taxable income.

. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. Calculations RM Rate TaxRM 0-2500. Tax Rates for Individual.

Introduction Individual Income Tax. Regarding expatriates who qualify for tax residency Malaysia has a progressive personal income tax system in which the tax rate increases as an individuals income increases starting at 0 and being capped at 25 before the assessment year of 2016 and 28 from 2016 onward. On the First 2500.

New Malaysia Personal Income Tax Rates 2016 Assessment Year 2015. On the First 5000 Next 15000. Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia.

PERSONAL INCOME TAX 3 Rates of tax Resident individuals YA 2015 YA 2016 Chargeable Income RM Rate Tax Payable RM Rate Tax Payable RM On the first On the next 5000 15000 1 0 150 1 0 150 On the first On the next 20000 15000 5 150 750 5 150 750 On the first On the next 35000 15000 10 900 1500 10 900 1500 On the first On the next. Remember two key things. Malaysia Personal Income Tax Rates Table 2017 Updates Budget Business News.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained. Assessment Year 2016 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. 13 rows Personal income tax rates.

The fixed income tax rate for non-resident individuals be increased by 3 from 25 to 28 from YA 2016. It also included increases in the child tax credit. 15 Tax incentives 16 Exchange controls 20 Setting up a business 21 Principal forms of business entity 22 Regulation of business 23 Accounting filing and auditing requirements 30 Business taxation 31.

Malaysia Non-Residents Income Tax Tables in 2019. Calculations RM Rate TaxRM A. While the 28 tax rate for non-residents is a 3 increase from the previous.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with. 0 0 votes. Wef YA 2016 tax rates for resident individuals whose chargeable income from RM600001 to RM1000000 be increased by 1 and chargeable income exceeding RM1000000 increased by 3.

Individual Income Tax Returns 2016 Individual Income Tax Rates 2016 28 Act of 2003 JGTRRA. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015. See the rates applicable to each income bracket in Table 1.

YA 2016 onwards Changes to Tax Relieves. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. EGTRRA included a new 10-percent tax rate bracket as well as reductions in tax rates for brackets higher than 15 percent of one-half percentage point for 2001 and 1 percentage point for 2002.

Chargeable income RM. 3 Indirect Tax 7 4 Personal Taxation 8 5 Other Taxes 9 6 Free Trade Agreements 10 7 Tax Authorities 11. 15 Tax incentives 16 Exchange controls 20 Setting up a business 21 Principal forms of business entity 22 Regulation of business 23 Accounting filing and auditing requirements 30 Business taxation 31 Overview 32 Residence 33 Taxable income and rates 34 Capital gains taxation 35 Double taxation relief 36 Anti -avoidance rules 37.

Individual Life Cycle. The maximum income tax rate is 25 percent and applies to an adjusted chargeable income of MYR 400000 or more 28. Tax relief for individual taxpayer whose spouse has no income is increased from RM3000 to RM4000.

Malaysia Personal Income Tax Rate. Home Income Tax GST FIR Online Online Filing Bare Acts Companies Act CPC CRPC IPC Legal Formats. New Malaysia Personal Income Tax Rates 2016 Assessment Year 2015 Resident Individual tax rates for Assessment Year 2013 and 2014.

If you have any other questions regarding personal income tax for the 2016 assessment year feel free to drop them in the comments section down below. Below are the IndividualPersonal income tax rates for the Year of Assessment 2013 and 2014 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. Tax relief for each child below 18 years of age is increased from RM1000 to RM2000 from year of assessment 2016.

New Malaysia Personal Income Tax Rates 2016 Assessment Year 2015. Calculations RM Rate Tax RM 0 -. On the First 5000.

Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Technical or management service fees are only liable to tax if the services are rendered in Malaysia.

Malaysian Personal Income Tax Pit 1 Asean Business News

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Income Tax Malaysia 2018 Mypf My

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

7 Tips To File Malaysian Income Tax For Beginners

Budget 2014 Personal Tax Reduced In 2015 Tax Updates Budget Business News

Individual Income Tax In Malaysia For Expatriates

Income Tax Malaysia 2018 Mypf My

Tax Guide For Expats In Malaysia Expatgo

Tax Guide For Expats In Malaysia Expatgo